The transition from casual side work to legitimate business operations represents a critical juncture for millions of Americans pursuing supplemental income streams. Tax obligations begin at $400 in annual net profit, making proper planning essential for individuals seeking to formalize their entrepreneurial activities while maintaining compliance with federal and state regulations.

Understanding the tax implications of business legitimization enables side hustlers to make informed decisions about structure, timing, and compliance requirements. TIG Tax Services provides comprehensive guidance through this complex transition, ensuring proper documentation and strategic positioning for long-term success.

Understanding the Formalization Threshold

The Internal Revenue Service mandates reporting requirements for individuals earning $400 or more annually from self-employment activities. This threshold triggers self-employment tax obligations regardless of whether the individual receives formal documentation such as 1099 forms from clients or platforms.

The IRS applies the "profit motive test" to determine business legitimacy, examining whether activities demonstrate genuine intent to generate profit rather than serve as hobbies. Individuals who earn money in three of the previous five years face presumption of business intent, requiring proper documentation and compliance measures.

Beyond federal requirements, several practical factors indicate the need for business formalization:

• Expense deduction opportunities become available only through legitimate business registration

• Legal liability protection requires formal business structures to separate personal and business assets

• Professional credibility increases with official registration and dedicated business banking relationships

• Growth potential necessitates proper infrastructure for scaling operations

• State-specific requirements may mandate registration based on revenue thresholds or business activities

Legal Registration Framework

Business structure selection forms the foundation of proper tax planning and operational compliance. Each structure carries distinct tax implications and administrative requirements that affect long-term strategy.

Sole proprietorships represent the simplest business form, requiring minimal paperwork while providing no liability protection. Income flows directly to personal tax returns through Schedule C, making this structure suitable for low-risk activities with limited growth projections.

Limited Liability Companies (LLCs) offer liability protection while maintaining tax flexibility. Single-member LLCs default to sole proprietorship tax treatment, while multi-member structures operate as partnerships for tax purposes. This structure provides professional credibility and growth flexibility.

S Corporations enable potential payroll tax savings for higher-earning businesses by allowing owners to take reasonable salaries while distributing additional profits as dividends. However, this structure requires formal payroll processing and additional compliance obligations.

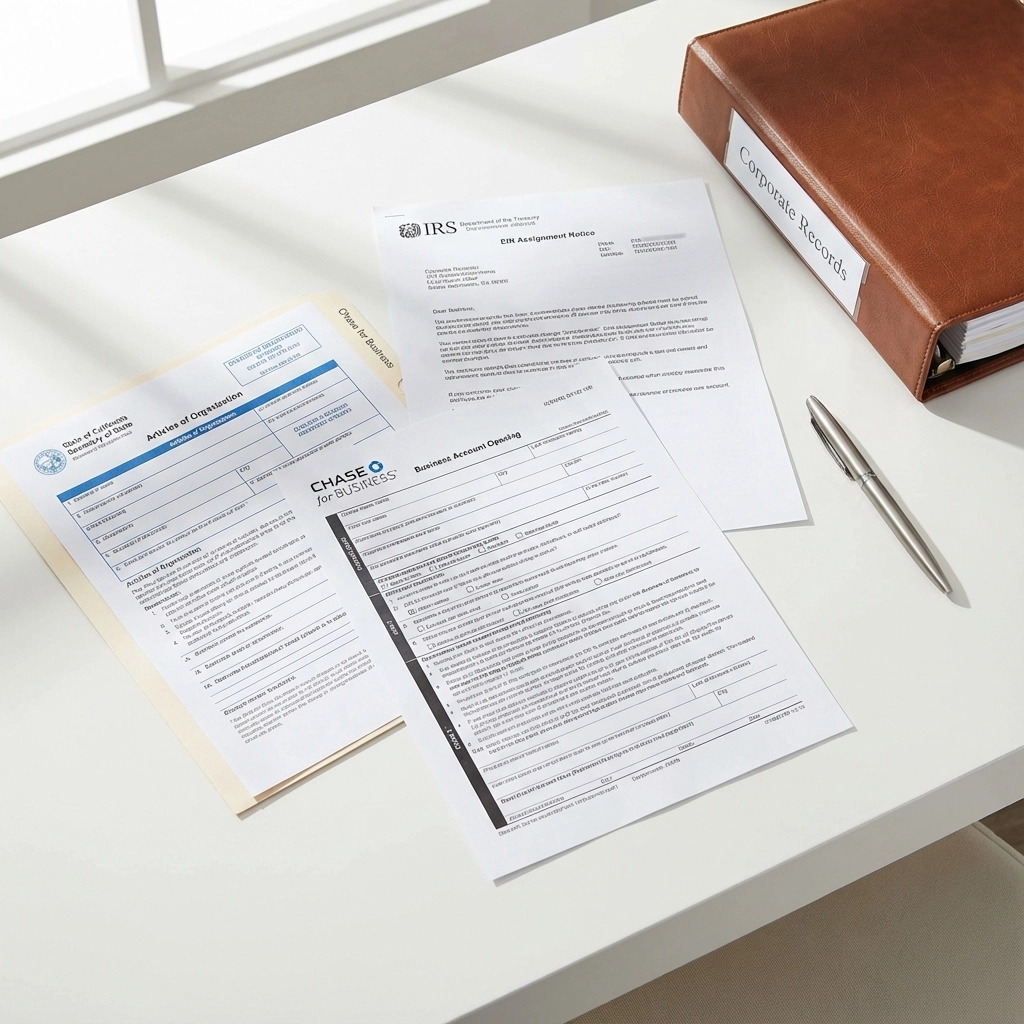

The registration process requires several sequential steps:

- Business name selection and verification through state databases to ensure availability

- State registration filing with appropriate Secretary of State offices

- Employer Identification Number (EIN) application through official IRS channels

- Business banking account establishment requiring EIN and registration documentation

- Local licensing and permit acquisition based on business type and location

Tax Filing Requirements by Business Structure

Tax filing obligations vary significantly based on selected business structure, creating distinct compliance pathways for different organizational types.

Sole Proprietorship and Single-Member LLC Filing

Schedule C (Profit or Loss from Business) serves as the primary reporting mechanism for sole proprietors, attaching to Form 1040 for individual tax returns. This schedule captures all business income and deductible expenses, calculating net profit subject to both income tax and self-employment tax.

Schedule SE (Self-Employment Tax) calculates Social Security and Medicare taxes on business profits exceeding $400 annually. The current self-employment tax rate of 15.3% applies to net earnings, with potential deductions available for the employer portion of these taxes.

Form 8829 (Expenses for Business Use of Your Home) enables home office deductions when dedicated space serves exclusively for business purposes. This deduction can significantly reduce taxable income for home-based operations meeting strict IRS requirements.

Partnership and Multi-Member LLC Requirements

Form 1065 (U.S. Return of Partnership Income) must be filed annually by March 15th for partnerships and multi-member LLCs. This informational return reports business income and expenses while distributing profit and loss allocations to individual partners through Schedule K-1 forms.

Partners receive K-1 forms detailing their distributive share of business income, which flows through to individual tax returns. This pass-through taxation avoids double taxation while requiring partners to pay taxes on allocated income regardless of actual distributions received.

S Corporation Compliance

Form 1120-S (U.S. Income Tax Return for an S Corporation) requires filing by March 15th annually. S Corporation status enables pass-through taxation while requiring reasonable salary payments to owner-employees, creating potential payroll tax optimization opportunities.

Owner-employees must receive reasonable compensation subject to payroll taxes, while additional profits distribute as non-wage income avoiding self-employment taxes. This structure requires formal payroll processing and quarterly employment tax deposits.

Quarterly Estimated Tax Management

Business income rarely includes automatic tax withholding, creating obligations for quarterly estimated tax payments to avoid penalties and interest charges. Form 1040-ES (Estimated Tax for Individuals) facilitates these payments, due on January 15th, April 15th, June 15th, and September 15th.

Safe harbor rules protect taxpayers from penalties when estimated payments equal 100% of prior year tax liability (110% for adjusted gross income exceeding $150,000). This approach provides certainty while potentially creating year-end tax obligations requiring careful cash flow management.

Business owners should calculate estimated payments based on projected annual income, considering both business profits and other income sources. TIG Tax Services assists clients in developing quarterly payment strategies that optimize cash flow while maintaining compliance.

Record Keeping and Documentation Standards

Comprehensive record keeping forms the backbone of legitimate business operations and tax compliance. The IRS requires supporting documentation for all claimed income and expenses, with specific retention periods and organizational standards.

Essential documentation includes:

• Income records from all sources, including 1099 forms, payment receipts, and bank deposits

• Expense receipts with business purpose notation and dates

• Mileage logs for business vehicle use with dates, destinations, and business purposes

• Home office documentation supporting exclusive business use claims

• Bank statements for dedicated business accounts

• Professional service contracts and client agreements

Digital organization systems enable efficient record keeping while ensuring accessibility during potential audits. Cloud-based storage solutions provide backup protection while facilitating professional tax preparation services.

The IRS generally requires three-year retention periods for most business records, with extended periods for specific situations such as property depreciation or employment tax obligations. TIG Tax Services provides clients with comprehensive record keeping guidance and annual organization strategies.

State and Local Tax Considerations

Business formalization triggers various state and local tax obligations beyond federal requirements. Sales tax registration becomes mandatory for businesses selling taxable goods or services, with collection and remittance obligations varying by jurisdiction.

State income tax requirements depend on business location and structure, with some states imposing additional business taxes or franchise fees. Multi-state operations face complex nexus rules determining filing obligations in various jurisdictions.

Local jurisdictions may impose business license fees, occupational taxes, or gross receipts taxes based on business activities and revenue levels. Professional guidance ensures comprehensive compliance while identifying potential optimization opportunities.

Professional Transition Strategy

The evolution from side hustle to legitimate business requires strategic planning addressing tax optimization, compliance requirements, and growth positioning. TIG Tax Services specializes in guiding entrepreneurs through this critical transition, providing expertise in structure selection, compliance implementation, and ongoing tax planning.

Professional tax preparation becomes increasingly valuable as business complexity grows. The potential for overlooked deductions, compliance errors, and strategic missed opportunities often exceeds the cost of professional services. TIG's expertise in small business taxation ensures optimal positioning for current year compliance and future growth planning.

Business owners benefit from quarterly check-ins to monitor income trends, adjust estimated payments, and identify tax planning opportunities. This proactive approach prevents year-end surprises while optimizing overall tax positions throughout the business lifecycle.

Strategic Implementation Timeline

Successful business formalization follows a structured timeline ensuring proper sequencing of legal and tax requirements:

Months 1-2: Structure selection, state registration, and EIN acquisition

Month 3: Business banking establishment and initial record keeping system implementation

Ongoing: Monthly income and expense tracking with quarterly estimated payment submissions

Annual: Comprehensive tax preparation with strategic planning for the following year

TIG Tax Services coordinates this timeline with clients, ensuring proper implementation while addressing unique circumstances and growth objectives. Professional guidance throughout this transition period establishes strong foundations for sustainable business operations and tax optimization strategies.

The transformation from side hustle to legitimate business represents both opportunity and responsibility. Proper tax planning and compliance implementation enable entrepreneurs to focus on growth while maintaining regulatory requirements. TIG's comprehensive services support this journey, providing expertise and guidance for successful business legitimization and long-term prosperity.