The modern economy has fundamentally shifted the traditional employment landscape. Millions of Americans now earn substantial income from side hustles, freelance work, and independent contracting, often exceeding their primary employment earnings. This income diversification presents unique tax challenges that require strategic planning and careful attention to compliance requirements.

When side hustle income surpasses traditional employment income, taxpayers enter a complex realm of self-employment taxation, quarterly payment obligations, and business deduction opportunities. Understanding these requirements is essential for maintaining compliance while maximizing tax efficiency.

Understanding Self-Employment Tax Implications

Self-employment income carries additional tax burdens beyond standard income tax. Unlike traditional employment where employers pay half of Social Security and Medicare taxes, self-employed individuals must pay the full 15.3% self-employment tax on net earnings exceeding $400.

This tax applies to income from freelancing, consulting, ride-sharing, online sales, rental activities, and other independent work. The self-employment tax rate consists of 12.4% for Social Security taxes on earnings up to $176,100 in 2025, plus 2.9% for Medicare taxes on all earnings. High earners face an additional 0.9% Medicare surtax on income exceeding $200,000 for single filers or $250,000 for married couples filing jointly.

Calculating Net Earnings from Self-Employment

Net earnings from self-employment equal total self-employment income minus allowable business deductions. Taxpayers must maintain detailed records of all income sources and business expenses to accurately calculate this figure. The IRS requires documentation supporting all claimed deductions, making thorough record-keeping essential.

Self-employed individuals can deduct the employer-equivalent portion of self-employment tax when calculating adjusted gross income. This deduction equals 7.65% of net self-employment earnings, partially offsetting the additional tax burden.

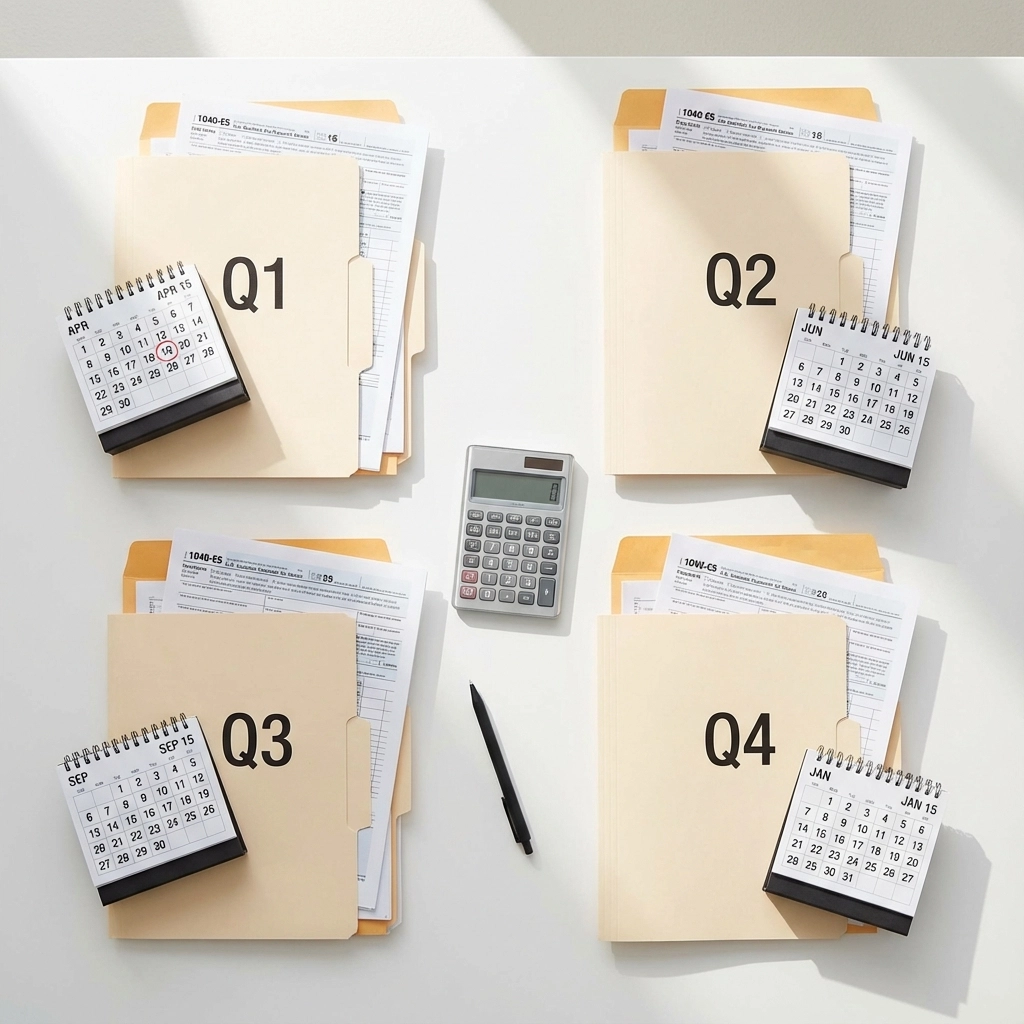

Quarterly Estimated Tax Payment Requirements

Taxpayers whose side hustle income creates a tax liability exceeding $1,000 must make quarterly estimated payments. These payments cover both income tax and self-employment tax obligations that employers would typically withhold from paychecks.

The IRS requires estimated payments by January 15, April 15, June 15, and September 15 for the respective quarters. Late payments incur penalties and interest charges, even when taxpayers receive refunds at year-end.

Safe Harbor Payment Calculations

Taxpayers can avoid underpayment penalties by meeting safe harbor requirements. These require paying either 90% of the current year's tax liability or 100% of the previous year's liability (110% for taxpayers with prior-year adjusted gross income exceeding $150,000).

Form 1040-ES provides worksheets for calculating quarterly payment amounts. Taxpayers should base calculations on projected annual income, considering both employment and self-employment earnings. Regular review and adjustment of these payments throughout the year helps maintain compliance and avoid year-end surprises.

Business Deduction Opportunities

Self-employed taxpayers can claim numerous business deductions unavailable to traditional employees. These deductions reduce taxable income and self-employment tax obligations, potentially providing significant tax savings.

Home Office Deductions

Taxpayers using part of their home exclusively for business purposes can claim home office deductions. The simplified method allows deducting $5 per square foot of home office space, up to 300 square feet, for a maximum $1,500 annual deduction.

The actual expense method permits deducting the business percentage of home-related expenses, including mortgage interest, property taxes, utilities, repairs, and maintenance. This method often provides larger deductions but requires detailed expense tracking and allocation calculations.

Vehicle and Travel Expenses

Business use of personal vehicles generates deductible mileage or actual expense claims. For 2025, the standard mileage rate is 70 cents per business mile. Taxpayers choosing actual expense deduction must track all vehicle costs and calculate the business use percentage.

Business travel expenses beyond daily commuting are fully deductible, including airfare, hotels, meals (generally 50% deductible), and incidental expenses. Detailed records documenting business purpose, dates, locations, and amounts are required for all claimed travel deductions.

Equipment and Supply Deductions

Business equipment purchases under $2,890 in 2025 can be immediately expensed using the de minimis safe harbor election. Larger equipment purchases may qualify for Section 179 expensing or bonus depreciation, allowing immediate deduction of significant business investments.

Office supplies, software subscriptions, professional development costs, and other ordinary business expenses are fully deductible when used exclusively for business purposes.

Record-Keeping Requirements and Best Practices

Accurate record-keeping forms the foundation of successful tax management for diversified income earners. The IRS requires taxpayers to maintain records supporting all income and deduction claims, with specific documentation requirements for different expense categories.

Income Tracking Systems

Taxpayers must track all income sources separately, maintaining records of payments received from each client or income stream. This includes 1099 forms from clients, payment processor records, cash receipts, and bank deposit documentation.

Digital payment platforms like PayPal, Venmo, and others now report payments exceeding $5,000 annually through Form 1099-K. Taxpayers should reconcile these reports with their own records to ensure accuracy and completeness.

Expense Documentation

Business expense records must include receipts, invoices, bank statements, and credit card records showing the amount, date, business purpose, and parties involved. The IRS accepts digital records and scanned documents, provided they remain clear and accessible.

Mileage logs must document date, destination, business purpose, and miles driven for each trip. GPS-based mileage tracking apps can simplify this process while providing IRS-compliant documentation.

Business Structure Considerations

Growing side hustle income may warrant forming a business entity to optimize tax treatment and provide legal protection. Different structures offer varying tax advantages and compliance requirements.

Sole Proprietorship vs. Business Entities

Sole proprietorships report business income and expenses on Schedule C, subjecting all net profits to self-employment tax. This structure requires minimal paperwork but offers no legal liability protection.

Single-member LLCs provide liability protection while maintaining pass-through taxation by default. Income and expenses flow through to the owner's personal tax return, similar to sole proprietorship treatment.

S-Corporation Elections

S-Corporation elections can reduce self-employment tax burden for profitable businesses. S-Corporation owners must pay themselves reasonable wages subject to employment taxes, while remaining profits pass through as distributions exempt from self-employment tax.

This strategy requires careful wage determination and additional payroll compliance, making professional consultation essential before implementing S-Corporation elections.

Tax Planning Strategies

Proactive tax planning becomes crucial when side hustle income grows substantially. Strategic timing of income and expenses, retirement contributions, and business investments can significantly impact tax liabilities.

Retirement Account Contributions

Self-employed individuals can establish SEP-IRAs, Solo 401(k)s, or SIMPLE IRAs to reduce taxable income while building retirement savings. These accounts offer higher contribution limits than traditional IRAs, providing substantial tax deferral opportunities.

SEP-IRA contributions can equal up to 25% of net self-employment earnings or $70,000 for 2025, whichever is less. Solo 401(k)s allow both employee and employer contributions, potentially enabling higher total contributions for profitable businesses.

Income and Expense Timing

Taxpayers can optimize tax outcomes by strategically timing income recognition and expense payments. Accelerating business expenses into the current tax year while deferring income to the following year can reduce current-year tax liabilities.

Equipment purchases, professional development expenses, and other deductible costs made before December 31 reduce the current year's taxable income, while January payments affect the following year's tax calculation.

Professional Consultation and Compliance Support

Complex tax situations arising from substantial side hustle income often warrant professional assistance. Tax professionals can provide strategic planning advice, ensure compliance with quarterly payment requirements, and optimize deduction strategies.

TIG Tax Services specializes in helping taxpayers navigate multi-income tax situations, providing comprehensive support from quarterly planning through year-end filing. Professional guidance becomes particularly valuable when considering business structure changes or implementing advanced tax strategies.

Regular consultation throughout the tax year enables proactive adjustments to estimated payments, strategic timing of business decisions, and optimization of available deductions. This approach minimizes year-end surprises while maximizing tax efficiency for diversified income portfolios.

For personalized assistance managing your diversified income tax obligations, contact the experienced professionals at TIG Tax Services to develop a comprehensive tax strategy tailored to your unique situation.