If you're driving for Uber, delivering food, freelancing, or running any kind of gig work, you've probably wondered whether you need to make quarterly tax payments. The short answer? It depends on how much you expect to owe the IRS this year.

Let's break this down in plain English so you can avoid those nasty penalty fees.

Do You Actually Need to Pay Quarterly Taxes?

The IRS has a simple rule: if you expect to owe $1,000 or more in federal taxes for the year, you need to make quarterly payments. This applies whether you're doing gig work full-time or just picking up some extra cash on weekends.

Here's what triggers quarterly tax requirements:

- You expect to owe at least $1,000 in federal taxes after accounting for any withholding and tax credits

- Your withholding and tax credits are less than 90% of this year's estimated tax liability

- Your withholding and tax credits are less than 100% of last year's tax liability

Important note: If you have net earnings from self-employment of $400 or more from gig work, you must file a tax return regardless of whether it's part-time or full-time work.

Understanding Self-Employment Tax

As a gig worker, you're considered self-employed in the eyes of the IRS. This means you're responsible for paying self-employment tax of 15.3% on your net earnings. This breaks down to:

- 12.4% for Social Security

- 2.9% for Medicare

This is separate from your regular income tax obligations. When you work for an employer, they pay half of these taxes for you. When you're self-employed, you pay both the employer and employee portions.

The Three Simple Steps to Avoid Penalties

Step 1: Calculate Your Expected Annual Tax Liability

First, you need to figure out how much you'll owe for the entire year. This includes:

- Income tax on your gig work earnings

- Self-employment tax (15.3% of net earnings)

- Any other income sources

If this total is $1,000 or more, you'll need to make quarterly payments. Don't worry if you can't predict your exact income – you can use estimates and adjust as needed.

Step 2: Use the Safe Harbor Rules

The IRS offers "safe harbor" protection to help you avoid penalties, even if your estimates aren't perfect. You'll be penalty-free if you pay the lesser of:

- 90% of your current year's estimated tax obligation, OR

- 100% of your previous year's tax bill (110% if your adjusted gross income exceeded $150,000)

Many gig workers find it easier to base their quarterly payments on last year's tax return, then make adjustments if their income changes significantly.

Step 3: Mark Your Calendar with Payment Deadlines

For 2026, quarterly estimated tax payments are due on:

- April 15 (for income earned January 1–March 31)

- June 15 (for income earned April 1–May 31)

- September 15 (for income earned June 1–August 31)

- January 15, 2027 (for income earned September 1–December 31)

Notice that the quarters aren't exactly three months each – the IRS has its own way of dividing the year.

How to Make Your Payments

You have several options for making quarterly tax payments:

Online through the IRS: Use the Electronic Federal Tax Payment System (EFTPS) or the IRS Direct Pay system for free electronic payments.

By phone: Call the Electronic Federal Tax Payment System at 1-888-353-4537, though there may be processing fees.

By mail: Send a check with Form 1040ES (Estimated Tax for Individuals).

Through your bank: Many banks offer online bill pay services that can send payments to the IRS.

Common Gig Worker Scenarios

Scenario 1: Part-Time Gig Work

If you have a regular job with tax withholding and do gig work on the side, you might not need quarterly payments. Check if your regular job withholds enough to cover your total tax liability, including the gig work income.

Scenario 2: Full-Time Gig Work

If gig work is your primary income, you'll almost certainly need to make quarterly payments since there's no automatic withholding.

Scenario 3: Multiple Income Streams

If you have various gig jobs, freelance work, or other self-employment income, add it all together to determine your quarterly payment needs.

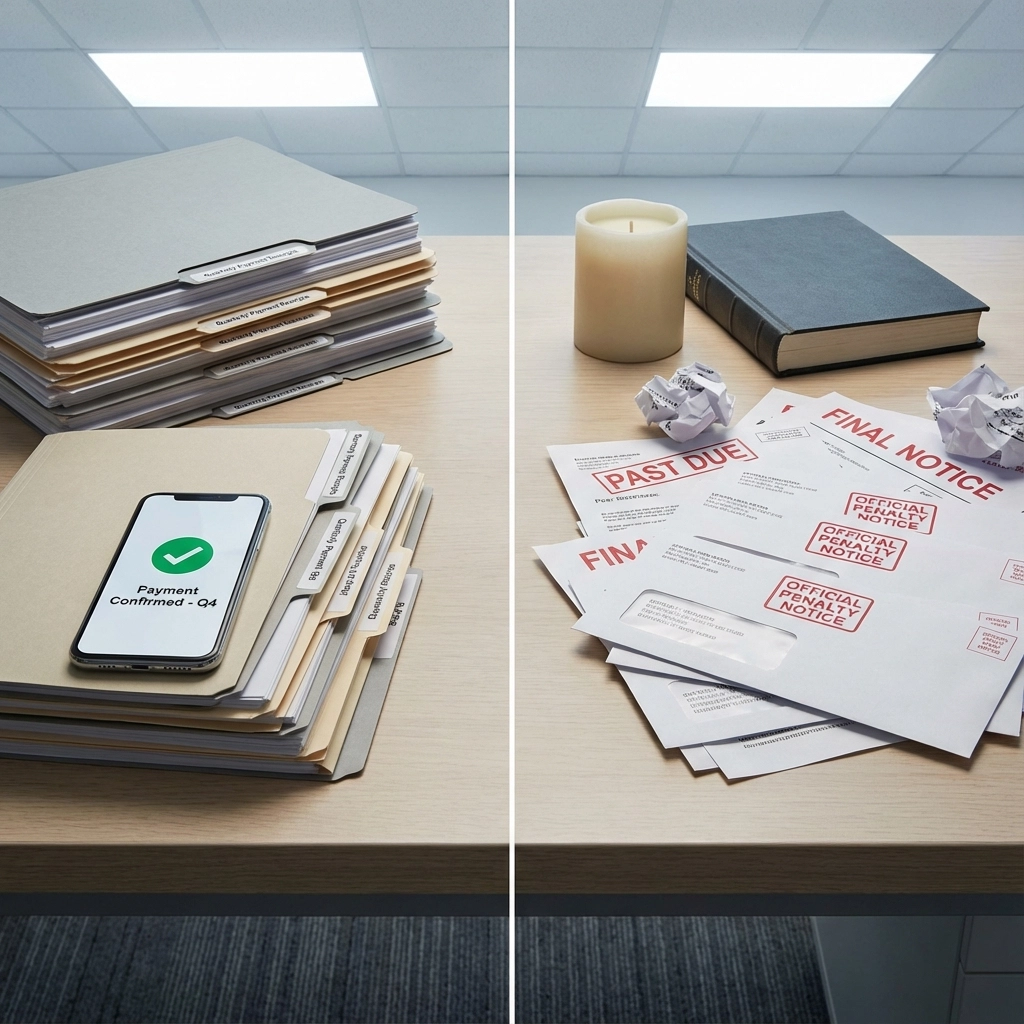

What Happens If You Miss Payments?

The IRS doesn't mess around with missed quarterly payments. If you don't meet the safe harbor requirements and owe $1,000 or more, you could face:

- Underpayment penalties

- Interest charges on the unpaid amount

- A larger tax bill at filing time

The penalty is typically calculated separately for each quarter you missed, so catching up quickly can minimize the damage.

Record Keeping for Gig Workers

To make quarterly payments accurately, you need good records of:

- All income from gig platforms (Uber, DoorDash, Upwork, etc.)

- Business expenses like vehicle costs, phone bills, equipment

- Estimated tax payments you've already made

- Any other tax withholding from other jobs

Most gig platforms will send you a 1099 form at year-end, but don't rely on these alone – keep your own records throughout the year.

Special Considerations for 2026

Keep in mind that tax laws and thresholds can change from year to year. For 2026, stay updated on:

- Any changes to quarterly payment requirements

- Updates to self-employment tax rates

- New deductions available to gig workers

- Changes to safe harbor rules

Getting Help with Your Quarterly Taxes

Calculating quarterly payments can be tricky, especially if your gig work income varies from month to month. Many gig workers find it helpful to work with a tax professional who can:

- Estimate your annual tax liability more accurately

- Help you take advantage of business deductions

- Ensure you're meeting safe harbor requirements

- Adjust your payments if your income changes

The investment in professional help often pays for itself through accurate planning and potential tax savings.

The Bottom Line

Quarterly tax payments aren't optional if you meet the IRS requirements – they're a pay-as-you-go system designed to collect taxes throughout the year rather than in one large lump sum at filing time.

The key is to start early, keep good records, and don't wait until the last minute to figure out your obligations. Even if you miss the first quarter, it's better to start making payments for the remaining quarters than to ignore the requirement entirely.

Remember, the IRS penalty for underpayment is typically less scary than it sounds, but it's still money out of your pocket that could be avoided with proper planning. When in doubt, it's usually better to overestimate slightly than to underpay and face penalties.

If you're unsure about your specific situation, consider consulting with a tax professional who can help you navigate the requirements and ensure you're meeting all your obligations while maximizing your deductions.