Estate planning has undergone a fundamental transformation in recent years. What was once considered a luxury reserved for high-net-worth individuals has become an essential financial practice for Americans across all income levels. The convergence of digital asset proliferation, evolving federal exemption thresholds, and changing family structures has created new imperatives that affect virtually every taxpayer.

The misconception that estate planning serves only the wealthy stems from outdated assumptions about asset composition and value. Today's digital economy has democratized wealth accumulation through cryptocurrency investments, online business ventures, and digital content creation. These assets require specialized planning considerations that traditional estate planning frameworks were not designed to address.

The Digital Asset Revolution Affects All Income Levels

Digital assets have fundamentally altered the estate planning landscape for Americans of all economic backgrounds. According to recent industry data, approximately 62% of Millennials allocate at least one-third of their wealth to cryptocurrencies, while both Millennials and Generation Z collectively hold the largest share of digital assets across all demographic groups.

This shift represents more than a generational preference for digital transactions. Digital assets now constitute significant portions of many individuals' total wealth, regardless of their overall net worth. A middle-income earner with moderate savings may hold thousands of dollars in cryptocurrency, accumulated loyalty points worth hundreds of dollars, and valuable digital content stored across multiple platforms.

The scope of digital assets extends far beyond cryptocurrency holdings. Modern digital estates typically include online banking and investment accounts through platforms like PayPal, Venmo, and Robinhood; cloud storage containing irreplaceable photos, videos, and documents; social media accounts that may generate revenue through monetization; email accounts containing important communications and records; domain names and intellectual property; loyalty programs and travel rewards; and subscription services with accumulated value.

Without proper digital asset planning, families face critical risks including permanent loss of access to valuable digital property, legal uncertainties and prolonged challenges for executors attempting to access accounts, privacy violations when handling sensitive personal data, and automatic account closure or deletion based on platform policies.

Common Misconceptions About Modern Estate Planning

Several persistent misconceptions prevent average Americans from engaging in appropriate estate planning activities. The most prevalent misconception assumes that estate planning primarily addresses federal estate tax concerns, which only affect estates exceeding $13.61 million in 2024. This assumption ignores the reality that estate planning addresses numerous issues unrelated to federal taxation.

Another significant misconception involves the perceived complexity and cost of estate planning services. Many individuals believe that comprehensive estate planning requires expensive legal procedures and extensive documentation. In reality, basic estate planning documents can address the majority of concerns facing typical families while remaining affordable and straightforward to implement.

The assumption that young adults do not need estate planning represents another critical oversight. Digital natives often accumulate substantial digital assets early in their careers through cryptocurrency investments, online business activities, and content creation. These assets require immediate planning attention to prevent permanent loss in the event of incapacity or death.

Evolving Federal Exemption Landscape

Federal estate tax exemptions have experienced significant changes in recent years, creating planning opportunities and challenges for a broader range of taxpayers. The Tax Cuts and Jobs Act substantially increased federal exemption amounts, but these increases are scheduled to sunset after 2025, potentially returning exemption levels to approximately $6 million per individual.

This sunset provision creates planning urgency for individuals whose estates may fall within the reduced exemption range. Taxpayers who previously assumed their estates would never trigger federal taxation may find themselves subject to estate taxes if exemption amounts decrease as scheduled.

State-level estate taxes add another layer of complexity. Several states maintain estate tax thresholds significantly lower than federal exemptions, meaning residents of these jurisdictions may face state estate taxation even when federal taxes do not apply. State exemption amounts vary considerably, with some states imposing taxes on estates exceeding $1 million.

Essential Steps for Average Clients

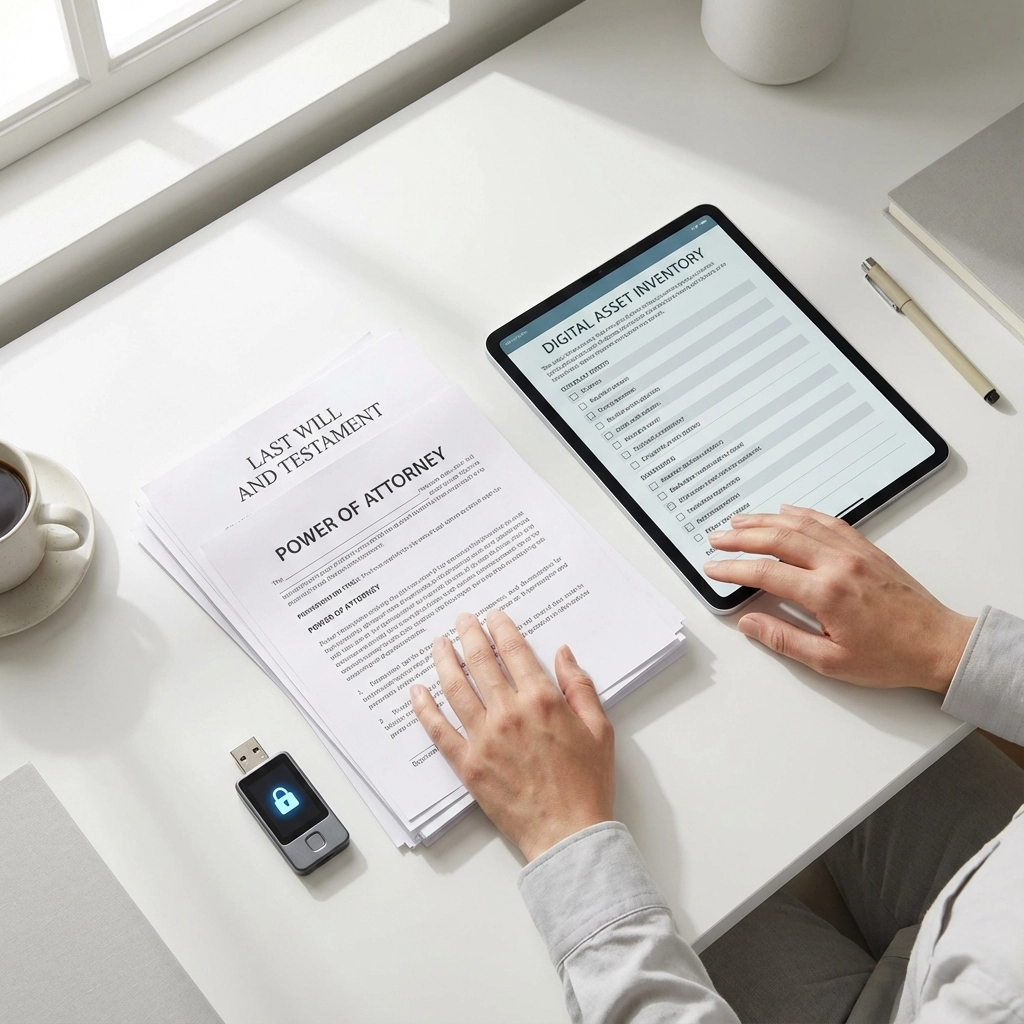

Comprehensive estate planning for average clients begins with creating a detailed inventory of all assets, both traditional and digital. This inventory should document physical assets, financial accounts, retirement plans, insurance policies, and all digital holdings including cryptocurrency wallets, online accounts, and valuable digital content.

Digital asset documentation requires specific attention to access credentials, recovery phrases, and storage locations. Private keys for cryptocurrency holdings must be stored securely using offline storage methods, secure password managers, or attorney-managed escrow arrangements. Without these credentials, digital assets may become permanently inaccessible regardless of legal inheritance rights.

Essential legal documents for average clients include a will that specifically addresses digital asset distribution, powers of attorney for financial and healthcare decisions, healthcare directives and HIPAA authorizations, and beneficiary designations for all applicable accounts. These documents should be reviewed and updated regularly, particularly after major life events such as marriage, divorce, birth of children, or significant changes in asset composition.

Beneficiary designation updates represent one of the most overlooked aspects of estate planning. Many individuals fail to update beneficiary information after life changes, resulting in unintended distributions. Regular reviews ensure that retirement accounts, life insurance policies, and other designated accounts align with current intentions.

Addressing Specific Digital Asset Categories

Cryptocurrency holdings require specialized planning approaches due to their unique characteristics. Unlike traditional assets, cryptocurrencies exist only in digital form and can be permanently lost if access credentials are misplaced. Proper cryptocurrency estate planning involves secure key storage, clear inheritance instructions, and educated beneficiaries who understand recovery procedures.

Online business assets and intellectual property require different considerations. Digital entrepreneurs may own valuable domain names, monetized social media accounts, or online businesses that generate ongoing revenue. These assets need specific valuation methods and transfer procedures that traditional estate planning may not address adequately.

Cloud storage accounts containing family photos, important documents, and personal memories represent irreplaceable assets that require careful planning. Many cloud storage providers have specific policies regarding account access after death, making advance planning essential for preserving these digital legacies.

Professional Guidance for Comprehensive Planning

The complexity of modern estate planning, particularly regarding digital assets and changing regulations, often requires professional guidance to ensure comprehensive coverage. Tax professionals can identify planning opportunities, ensure compliance with current regulations, and coordinate estate planning activities with ongoing tax strategies.

Professional guidance becomes particularly valuable when coordinating state and federal requirements, addressing complex digital asset holdings, planning for business succession, and navigating changing tax regulations. These professionals can also provide ongoing monitoring and updates as laws and personal circumstances change.

Estate planning attorneys bring specialized knowledge of state-specific requirements and legal procedures necessary for effective planning. They can draft appropriate legal documents, address complex family situations, and ensure that planning strategies comply with current legal standards.

Implementation Timeline and Ongoing Maintenance

Effective estate planning implementation follows a systematic approach beginning with immediate priorities such as basic will preparation, power of attorney designation, and beneficiary updates. These foundational elements provide essential protection while more comprehensive strategies are developed.

Medium-term planning activities include digital asset inventory completion, trust establishment if appropriate, and coordination with financial advisors and tax professionals. Long-term planning involves regular reviews, updates based on law changes, and adjustments for evolving family circumstances.

Annual estate plan reviews have become increasingly important due to rapid changes in digital platforms, tax regulations, and asset values. These reviews should address new digital assets, platform policy changes, beneficiary updates, and regulatory developments that may affect planning strategies.

The democratization of wealth through digital assets and changing exemption landscapes has made estate planning essential for Americans across all income levels. Proper planning protects accumulated wealth, provides for family members, and prevents the permanent loss of valuable digital assets. Professional guidance through qualified tax services ensures that planning strategies address current requirements while adapting to ongoing changes in regulations and technology.