Tax refund scams continue to proliferate during filing season, with fraudulent text messages and emails targeting taxpayers who are expecting refunds. These phishing attempts are designed to steal personal information, financial data, and ultimately, taxpayer identities. Understanding how to identify these scams and verify refund status through legitimate channels is essential for protecting personal information and financial security.

Understanding Tax Refund Phishing Schemes

Scammers use increasingly sophisticated techniques to impersonate the Internal Revenue Service and state tax agencies. These fraudulent communications often appear official, complete with government logos, reference numbers, and links that closely resemble legitimate government websites. The core objective remains consistent: to trick taxpayers into providing sensitive information or clicking malicious links.

The IRS and state tax offices never initiate contact via text message, email, or social media to request personal information. This fundamental fact serves as the foundation for identifying scam attempts. Any unsolicited digital communication claiming to be from a tax agency and requesting action should be treated with immediate suspicion.

Seven Critical Warning Signs of Refund Scams

1. Unsolicited Contact Through Digital Channels

Legitimate tax agencies do not send unsolicited text messages or emails about refund status. The IRS primarily communicates through official postal mail. Any text or email that arrives without a taxpayer having specifically requested information through official channels represents a red flag.

2. Embedded Links Requiring Immediate Action

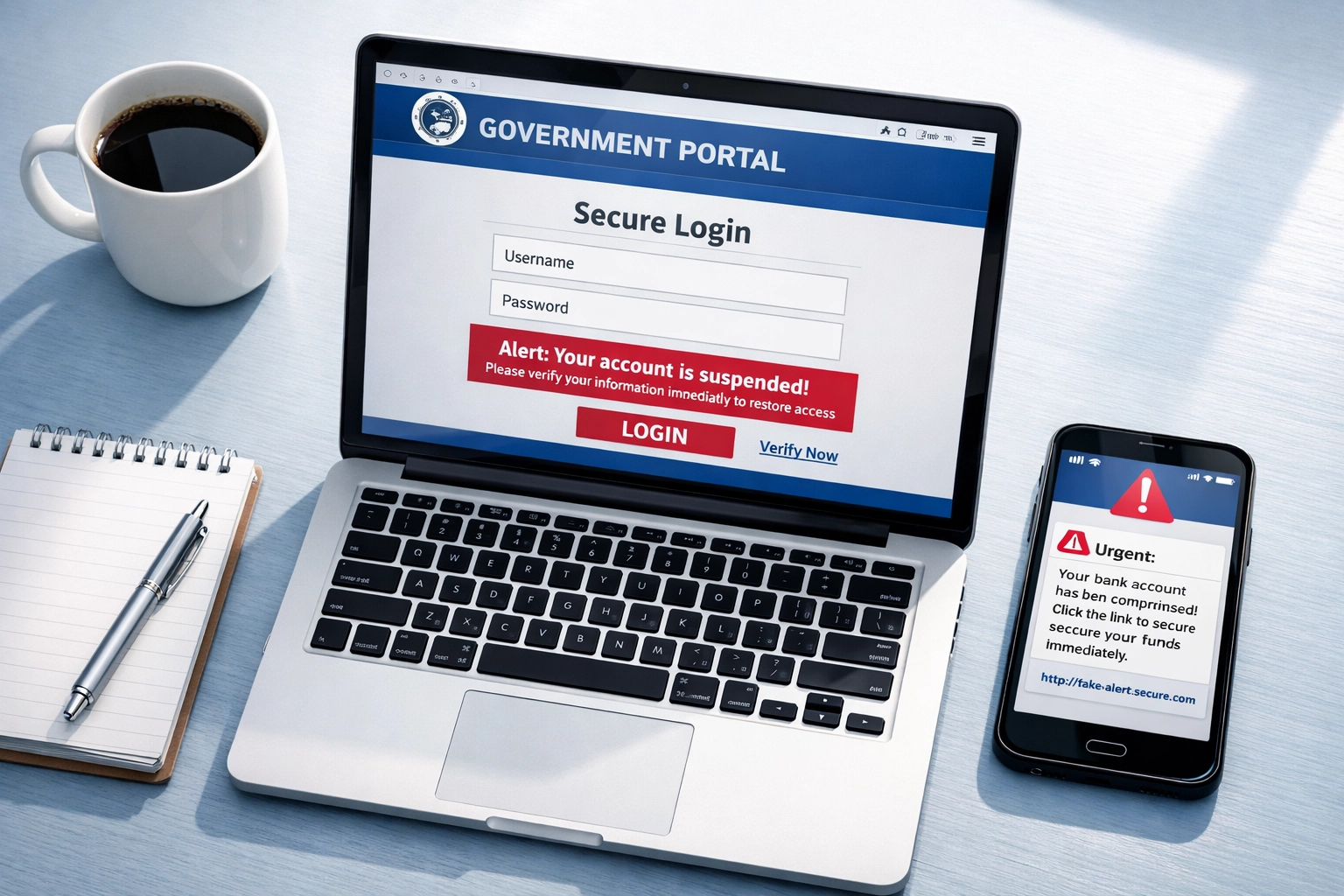

Scam messages typically contain clickable links that direct recipients to fraudulent websites designed to capture login credentials, Social Security numbers, bank account information, or other sensitive data. These phishing pages often mirror the appearance of official government sites, making them difficult to distinguish from legitimate resources without careful examination.

3. Requests for Personal or Financial Information

Authentic IRS communications do not ask taxpayers to verify their identity by providing Social Security numbers, bank account details, credit card information, or PINs through digital channels. Messages requesting this type of information should be deleted immediately without clicking any embedded links.

4. Urgent or Threatening Language

Scammers employ psychological pressure tactics to prompt immediate action. Common threatening phrases include:

- "Your account has been put on hold"

- "Unusual Activity Report detected"

- "Your refund is delayed pending verification"

- "Immediate action required to avoid penalties"

- "Your tax refund is at risk"

These messages create artificial urgency designed to bypass rational decision-making and prompt hasty responses.

5. Claims of Problems or Discrepancies

Fraudulent messages frequently allege that filing discrepancies, identity verification issues, or processing errors have occurred. A typical scam message might state: "Your tax refund is on hold due to a filing discrepancy under updated 2026 rules. Verify your identity now to avoid delays."

The IRS does not notify taxpayers of such issues via text message or email. Genuine processing problems are communicated through official postal mail with detailed instructions and taxpayer rights information.

6. Official Appearance Without Requested Contact

Even when messages include official-looking logos, seal images, reference numbers, and links that superficially resemble government URLs, the absence of requested contact indicates a scam. Sophisticated fraudsters invest significant effort in creating convincing forgeries of government communications.

7. Promises of Expedited Processing or Special Access

Messages offering guaranteed faster refunds, special access to processing systems, or government-backed assistance programs that taxpayers were unaware of applying for represent clear scam indicators. Legitimate tax processing follows established timelines and procedures without special expediting services offered through unsolicited communications.

Legitimate Methods for Checking Refund Status

Taxpayers should exclusively use official channels to verify refund information. These secure methods protect personal information while providing accurate status updates.

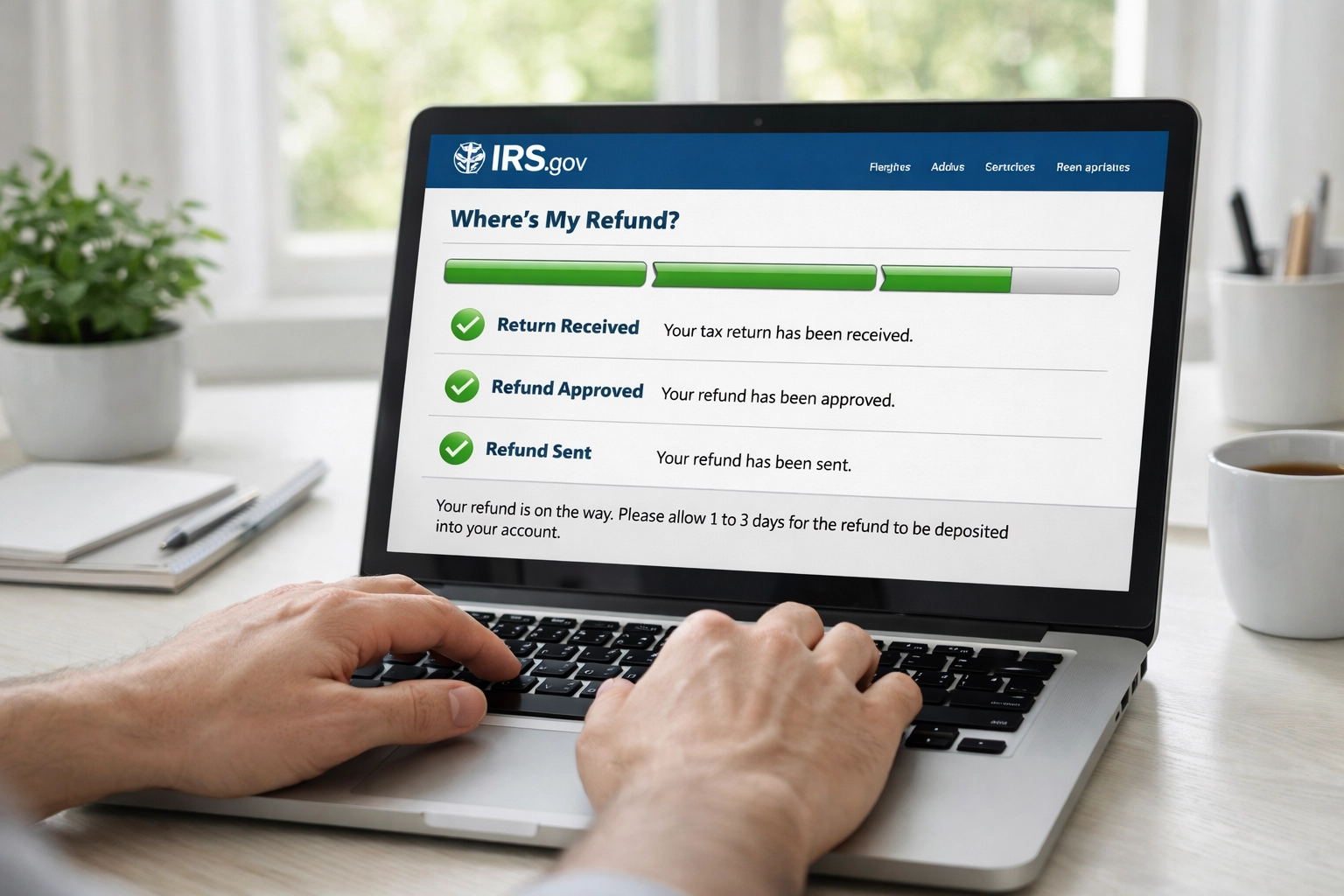

IRS Where's My Refund Tool

The IRS provides the Where's My Refund online tool, accessible directly through the official IRS.gov website. Taxpayers should manually type the URL rather than following links from emails or text messages. This tool requires:

- Social Security number or Individual Taxpayer Identification Number

- Filing status

- Exact refund amount shown on the tax return

The system updates overnight, and information typically becomes available within 24 hours after the IRS receives an e-filed return or four weeks after mailing a paper return.

IRS2Go Mobile Application

The official IRS2Go mobile application provides refund status information using the same secure verification process as the online tool. Taxpayers should download the application exclusively from official app stores and verify the publisher is listed as the Internal Revenue Service.

Telephone Inquiry System

The IRS automated refund hotline at 1-800-829-1954 provides status information without speaking to a representative. This system uses the same information required for online checking and operates 24 hours daily.

State Tax Agency Resources

State tax refunds follow separate processing timelines from federal refunds. Taxpayers should access their state's department of revenue website directly by typing the URL rather than following links. Each state provides dedicated refund status tools requiring similar verification information.

Immediate Steps After Receiving a Suspicious Message

Taxpayers who receive suspected scam communications should take specific protective actions:

Report the Message

Forward suspicious emails to phishing@irs.gov and then delete them. Text message scams should be reported by forwarding to 7726 (SPAM). This number is monitored by cellular carriers to identify and block fraudulent messaging sources.

The Federal Trade Commission accepts reports through ReportFraud.ftc.gov, which helps authorities track and investigate scam operations.

Delete Without Interaction

After reporting, delete the message without clicking any links, downloading attachments, or responding. Even clicking a link without providing information can expose devices to malware or confirm active phone numbers and email addresses to scammers.

Use Device Security Software

If a link was clicked or information was inadvertently provided, immediately run comprehensive security scans using updated antivirus and anti-malware software. Change passwords for financial accounts, email, and any IRS online account credentials.

What to Do If Personal Information Was Compromised

Taxpayers who provided personal information to suspected scammers should take immediate protective measures:

Contact the IRS Identity Protection Specialized Unit at 1-800-908-4490 to report the incident and receive guidance on protecting tax accounts.

File IRS Form 14039, Identity Theft Affidavit, which alerts the IRS to potential fraudulent filing attempts using the compromised information.

Request an Identity Protection PIN (IP PIN), a six-digit number assigned annually that must be entered on tax returns to verify taxpayer identity and prevent fraudulent filings.

Monitor credit reports through all three major credit bureaus and consider placing fraud alerts or credit freezes.

Report the incident to local law enforcement and obtain a police report, which may be required when disputing fraudulent transactions.

Enhanced Security Measures for Tax Season

Beyond responding to specific scam attempts, taxpayers should implement proactive security practices:

Create or access an IRS Online Account through the official website to monitor account activity, view transcripts, and receive legitimate notifications.

Enable multi-factor authentication for all financial and tax-related accounts.

Use strong, unique passwords for tax preparation software and online accounts, stored in secure password management systems.

Shred physical documents containing personal information before disposal.

File tax returns as early as possible in the filing season, reducing the window for identity thieves to file fraudulent returns.

Professional Tax Preparation Security

Working with reputable tax preparation professionals provides additional security layers. Established firms implement data protection protocols, secure document transmission methods, and professional liability coverage. They also stay current on evolving scam tactics and can help clients identify suspicious communications.

The Bottom Line

Tax refund scams represent a persistent and evolving threat throughout filing season and beyond. The IRS estimates that thousands of taxpayers fall victim to phishing schemes annually, resulting in identity theft, fraudulent refund claims, and significant financial losses.

Taxpayers must remain vigilant when receiving any unsolicited digital communication claiming to be from tax agencies. The fundamental principle remains unchanged: legitimate tax authorities do not initiate contact through text messages, emails, or social media to request personal information or immediate action regarding refunds.

When questions arise about refund status or tax account issues, taxpayers should contact the IRS or their state tax agency directly using verified contact information from official websites. Taking time to verify information through legitimate channels prevents the costly and time-consuming consequences of identity theft and tax fraud.

For taxpayers who need assistance navigating tax filing, refund tracking, or responding to suspected scam attempts, professional tax services provide expert guidance and support throughout the process. Contact TIG Tax Services for comprehensive tax preparation and protection assistance.