Taxpayers seeking quick access to their refunds often encounter two distinct financial products during tax preparation: refund transfers and refund advance loans. While these options may appear similar at first glance, they function through fundamentally different mechanisms and carry varying implications for timing, costs, and overall value. Understanding the distinctions between these products enables taxpayers to make informed decisions aligned with their financial needs and circumstances.

Understanding Refund Transfers

Refund transfers represent a bank deposit product rather than a loan. This mechanism allows taxpayers to pay their tax preparation fees directly from their refund rather than paying upfront. When a taxpayer elects this option, the IRS deposits the refund into a temporary bank account established by the tax preparer or their financial partner. The preparation fees are deducted from this account, and the remaining balance is then disbursed to the taxpayer.

The refund transfer process involves several key steps:

- The IRS processes the tax return according to standard timelines

- The refund is deposited into the temporary holding account

- Tax preparation fees and any associated transfer fees are automatically deducted

- The remaining funds are disbursed to the taxpayer's chosen account or via check

Major tax preparation providers typically charge between $42 and $67 for refund transfer services, depending on the disbursement method selected. An additional $25 fee commonly applies when taxpayers request paper check disbursement rather than direct deposit.

Critical distinction: Refund transfers do not accelerate IRS processing times. Taxpayers receive their refunds according to the standard IRS schedule, which typically ranges from 21 days for electronically filed returns with direct deposit to several weeks for paper returns.

Understanding Refund Advance Loans

Refund advance loans constitute actual short-term loans issued against expected tax refunds. These financial products provide immediate access to a portion of the anticipated refund, typically ranging from $500 to $4,000, depending on the provider and the taxpayer's eligibility.

The refund advance process operates as follows:

- Taxpayers apply for the loan during or after tax return preparation

- The lender evaluates eligibility based on the expected refund amount and other criteria

- Upon approval, funds are disbursed immediately: often the same day

- When the IRS issues the actual refund, it is deposited with the lender

- The loan amount plus any applicable fees or interest is deducted

- Any remaining refund balance is forwarded to the taxpayer

Eligibility requirements for refund advance loans typically include:

- A minimum expected federal refund (often $500 or more)

- Filing electronically with direct deposit

- Meeting the lender's underwriting criteria

- No outstanding debts or obligations to the tax preparation company

Speed Comparison: Which Delivers Funds Faster?

Refund advance loans provide significantly faster access to funds. Major tax preparation providers offering these products typically deliver same-day funding upon approval. Some providers deposit funds to prepaid debit cards immediately, while bank account transfers may take one to five business days depending on the institution.

In contrast, refund transfers do not expedite the receipt of funds beyond standard IRS processing timelines. The only potential time advantage occurs at the end of the process: once the IRS releases the refund to the temporary account, the remaining funds after fee deduction are typically disbursed faster than waiting for a paper check from the IRS. However, this advantage represents a marginal improvement of perhaps a few days at most.

For taxpayers requiring immediate access to refund dollars, refund advance loans clearly win on speed.

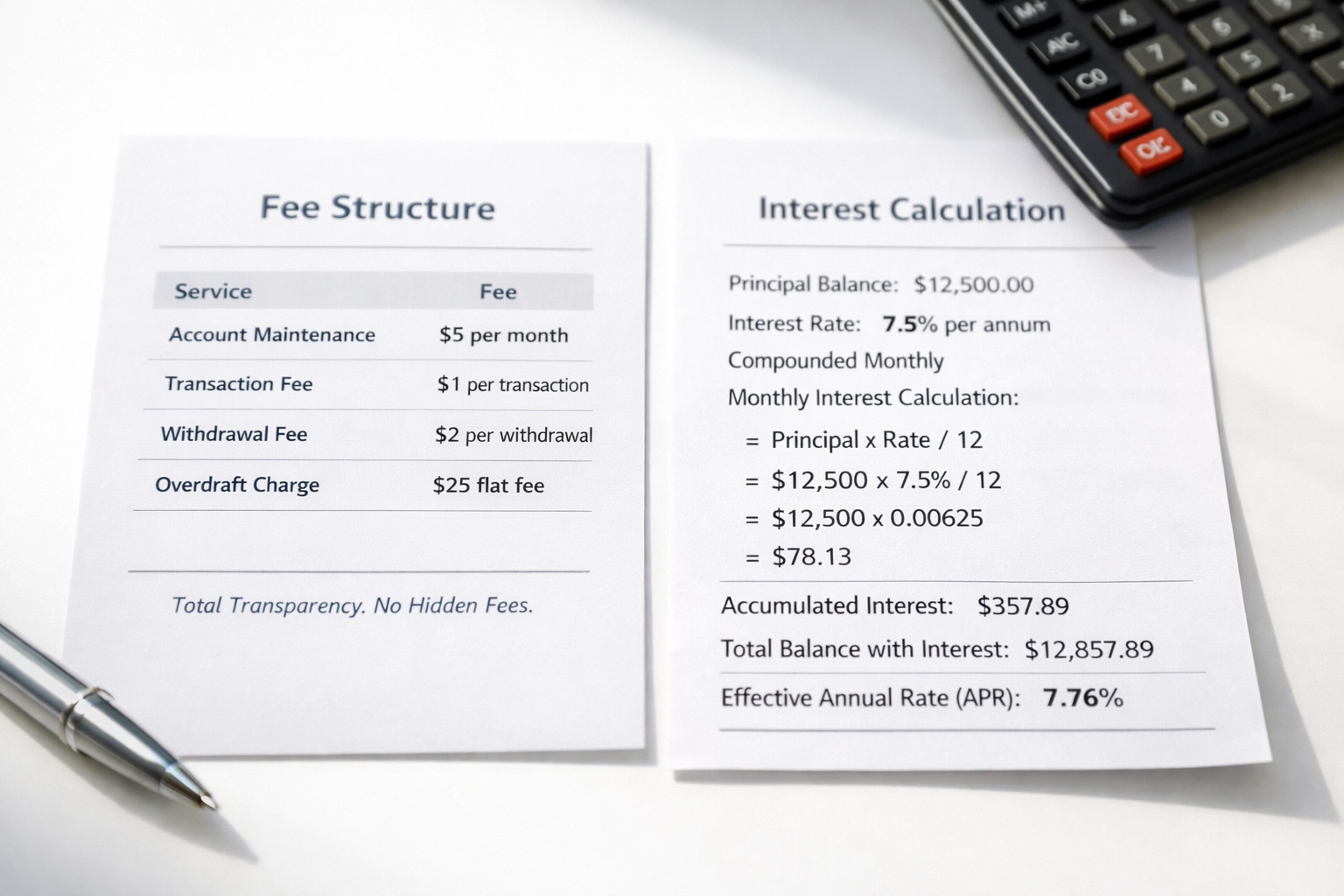

Fee and Cost Analysis: The Hidden Cost Reality

The fee structures for these products vary dramatically between providers, and this variation carries significant implications for taxpayers.

Refund Transfer Fees

Refund transfer fees are transparent and fixed. Most providers charge:

- Base transfer fee: $42–$50

- Paper check disbursement: Additional $25

- Total potential cost: $42–$75

These fees are clearly disclosed and do not vary based on refund amount or processing time. Taxpayers know exactly what they will pay before selecting this option.

Refund Advance Loan Fees

The cost structure for refund advance loans varies substantially by provider:

No-fee providers: Some major tax preparation companies, most notably H&R Block, offer refund advance loans with 0% APR and no loan fees or finance charges. For taxpayers working with these providers, the refund advance represents genuinely free access to early funds.

High-cost providers: Other companies charge substantial interest and fees. Common rates include:

- Annual Percentage Rates (APR): 35.99%–36.0%

- Example cost: A $2,500 loan held for 33 days at 36.0% APR costs approximately $81 in interest

- Total repayment: $2,581 for a $2,500 advance

The dramatic cost difference between providers means taxpayers must carefully evaluate which company they choose for tax preparation if they intend to utilize a refund advance loan.

Which Option Best Serves Different Taxpayer Situations

When Refund Transfers Make Sense

Taxpayers should consider refund transfers when:

- They prefer paying tax preparation fees from their refund rather than upfront

- They do not require immediate access to funds

- They want predictable, transparent fees

- Their tax preparer charges interest or fees for refund advance loans

When Refund Advance Loans Provide Greater Value

Refund advance loans offer advantages for taxpayers who:

- Face urgent financial needs requiring immediate fund access

- File with providers offering 0% APR loans (such as H&R Block)

- Have verified expected refund amounts meeting minimum loan thresholds

- Meet lender eligibility requirements

Critical consideration: Taxpayers should never select a refund advance loan from a high-interest provider simply for convenience. The costs associated with 36% APR loans substantially erode refund value and rarely justify the benefit of receiving funds a few weeks earlier.

Important Considerations and Recommendations

Verify All Fees in Writing

Tax preparation offices must provide written disclosure of all fees associated with refund transfers and advance loans. Taxpayers should request and review these disclosures before agreeing to any service. Questions to ask include:

- What is the exact fee for the refund transfer?

- Does the refund advance loan carry any interest charges or fees?

- What is the APR if applicable?

- Are there additional fees for specific disbursement methods?

Consider Free Alternatives

Many taxpayers can avoid both products by:

- Paying preparation fees upfront: This eliminates refund transfer costs

- Waiting for standard IRS processing: Most electronically filed returns with direct deposit arrive within 21 days

- Using IRS Free File: Taxpayers with income below $79,000 qualify for free tax preparation software

Understand IRS Processing Timelines

The IRS provides estimated refund schedules based on filing method and date. Taxpayers can check their refund status using the "Where's My Refund?" tool at IRS.gov approximately 24 hours after filing electronically. Understanding realistic processing timelines helps taxpayers determine whether accelerated access justifies associated costs.

Beware of Marketing Language

Tax preparation companies often market refund-related products using appealing but potentially misleading language. Terms like "instant refund," "tax advance," or "early refund" may obscure the fact that these products are loans with costs attached. Taxpayers should look beyond marketing materials to understand actual product mechanics and fees.

The Bottom Line

For taxpayers requiring immediate fund access and working with no-fee providers, refund advance loans deliver clear value: same-day funding without cost. However, taxpayers considering refund advance loans from high-interest providers should carefully evaluate whether receiving funds two to three weeks earlier justifies paying 35-36% APR.

Refund transfers serve a different purpose: enabling taxpayers to pay preparation fees from their refunds rather than upfront: but provide no speed advantage over standard IRS processing. The transparent fee structure makes this option predictable but not necessarily faster.

TIG Tax Services recommends taxpayers carefully review all fee disclosures, compare provider offerings, and select refund-related products that align with genuine financial needs rather than convenience alone. In most cases, patience for standard IRS processing delivers the full refund value without unnecessary fees or interest charges.

Taxpayers seeking personalized guidance on refund options and tax preparation strategies can contact TIG Tax Services at https://tigtaxservices.com for professional consultation during the current filing season.